Inside the Ashcroft Capital Lawsuit: What Real Estate Investors Need to Know

You invest in real estate to build wealth, not to worry about lawsuits and broken promises. But when a major firm like Ashcroft Capital faces legal trouble, it naturally raises concerns especially if your money is involved.

The case has created serious questions about how investor funds were handled, whether returns or not, and if the people in charge fulfilled their jobs. Even if you’re not directly affected, It’s a reminder to not just trust big promises, but to check where your money is really going.

Let’s explore the details that lie in this case.

Table of Contents

Understanding the Ashcroft Capital Lawsuit Dispute

Ashcroft Capital is a famous name in the world of multifamily real estate. It is founded by Joe Fairless and Frank Roessler, this firm built its reputation by acquiring and managing large apartments across the U.S., mostly in collaboration by everyday investors through private placements.

Then due to some issues a group of limited partners came forward, accusing the company of misleading financial projections, failing to provide timely updates, and potentially misusing investor funds.

Ashcroft Capital Lawsuit filed in a U.S. District Court by different allegations. It is a breach of fiduciary duty. Investors say they weren’t given the full details and that returns didn’t match what was promised.

Key points behind the legal dispute:

- False projections shared in marketing materials and investor decks

- Delayed or vague reporting, especially on cash flow and distributions

- Questions about fund use, including capital call allocations

- Incomplete disclosures in the Private Placement Memorandum (PPM)

- Failed to maintain transparency in investor communications

For those who’ve put their trust and money into similar deals, this case is more than a headline. It’s a signal to look closer at how firms operate behind the scenes, and how much transparency really exists between general partners (GPs) and limited partners (LPs).

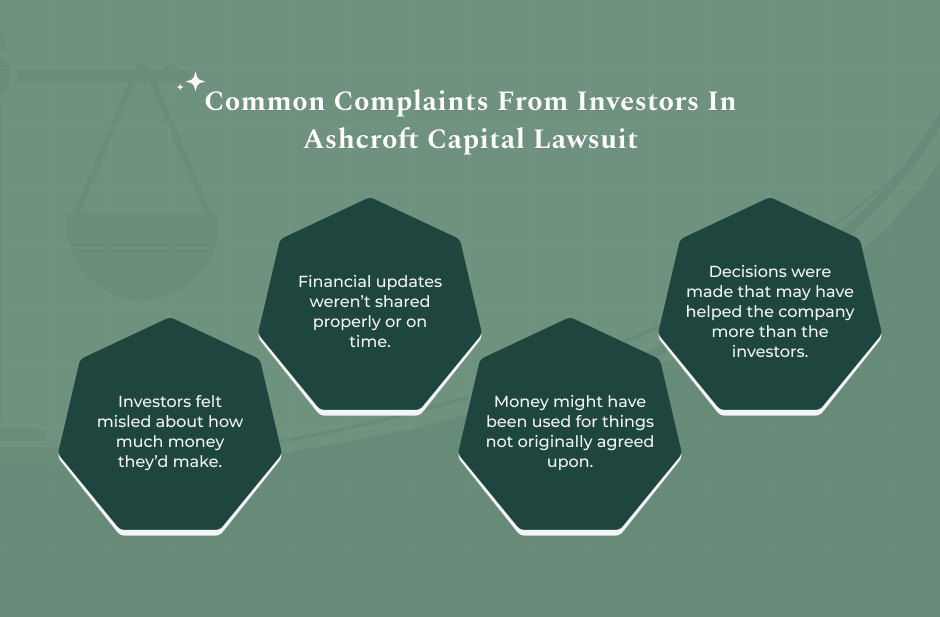

Allegations and Investor Complaints

Ashcroft Capital Lawsuit outlines serious claims that go beyond minor reporting errors. Investors allege that Ashcroft Capital failed to deliver on its promises, both in terms of returns and responsible fund management. These allegations suggest not just poor communication but potential legal violations.

The complaint concerns about how investor expectations were shaped versus what actually occurred after funds were committed. While private syndications always carry some risk, investors say they weren’t given accurate or complete information to make informed decisions.

Here are the main allegations raised in the legal filing:

- Misrepresentation of projected returns

Investors claim the returns shared during the fundraising phase were exaggerated or based on unrealistic assumptions. - Unauthorized use of investor funds

Some plaintiffs say funds were used in ways not disclosed in offering documents, such as shifting capital across unrelated projects. - Breach of fiduciary duty

Another allegation is that the firm did not act in the best interest of its partners, failing to prioritize investor outcomes. - Delayed or inconsistent financial updates

Investors report difficulty accessing timely reports, cash flow summaries, and asset performance details. - Lack of clarity in offering documents

The Private Placement Memorandum (PPM) and other legal disclosures allegedly left out key risks or lacked transparency

Make a picture something like that from canva (do not use this photo this is just for reference)

Key Parties and Legal Proceedings

The legal action against Ashcroft Capital involves several key players on both sides. On one end, you have a group of limited partners (LPs) investors who claim they were misled and financially harmed. On the other, Ashcroft Capital Lawsuit and its leadership team are working to defend their practices and maintain their position in the real estate syndication space.

This case handle currently in the U.S. District Court for the District of New Jersey, where it has entered the early litigation phase. That includes legal filings, responses, and the beginning of discovery, where both sides exchange information and evidence.

| Category | Details |

| Plaintiffs | Group of Limited Partners (LPs) who invested in Ashcroft Capital deals |

| Defendants | Ashcroft Capital, Joe Fairless (co-founder), and other involved executives |

| Court Jurisdiction | U.S. District Court – District of New Jersey |

| Main Allegations | – Misrepresentation of returns- Breach of fiduciary duty- Securities fraud- Non-compliance with Reg D |

| Current Status | – Case filed and responded to- Motions in progress- Discovery underway |

| Possible Legal Outcomes | – Dismissal- Out-of-court settlement- Full trial with potential penalties |

| Industry Implications | People are now looking more closely at how real estate deals are managed and how investors are treated |

Financial and Legal Implications for Investors

When a firm like this big name faces legal trouble, it doesn’t just affect its leadership it impacts investors like you. Even if you’re not part of the lawsuit, its effect can show up in your end, communication from the firm, and the overall confidence you have in the deal.

Here’s how this situation could directly or indirectly affect investors:

| Key Impacts | Advisory Notes for Investors |

| Suspended DistributionsCash flow may be delayed or stopped while legal matters are resolved. | Review your PPM and investor agreementUnderstand your rights, exit terms, and how funds were intended to be used. |

| Reduced Asset ValueLitigation may impact property performance, refinancing, or sale outcomes. | Track official communicationsStick to verified updates via investor portals or legal filings not speculation. |

| Loss of Investor ConfidenceInvestor trust in the firm can drop, affecting future deal participation. | Consult a securities attorneyGet professional advice if you think your investment is at risk. |

| Higher Legal RiskRegulatory bodies like the SEC may investigate if securities laws were breached. | Stay alert for regulatory updatesWatch for enforcement actions that could change how the fund operates. |

| Difficulty Withdrawing FundsLegal and financial restrictions may limit your ability to exit or access capital. | Reassess your investment strategyUse this experience to make your approach better to syndication and risk. |

Investor Response and Next Steps

If you’ve invested with Ashcroft Capital Lawsuit or are watching from the outside, now is a good time to take a step back. Situations like this show why it’s important to be careful, ask the right questions, and make sure your money is in safe hands.

Here’s what you can do now:

Review All Investment Documents

Take another look at your investment papers, like the PPM, subscription forms, and updates. Make sure you understand what you agreed to and if anything seems unclear now.

Notice the Lawsuit’s Progress

Keep up with trusted updates like court records or legal news. Try not to rely on social media or rumors they can be misleading.

Stay Connected with Legal and Financial Advisors

If you think you were misled or lost money, talk to a lawyer who knows investment cases. They can help you decide if you should take legal action or do something on your own.

Talk To Other Investors

Joining online groups or forums can help you learn more and see what others in the same situation are doing.

Reevaluate Future Investment Criteria

Take this as a chance to learn. In the future, look for deals that are open about their numbers, get independent audits, and share clear financial updates.

Conclusion

The Ashcroft Capital lawsuit is a clear warning for real estate investors.When trust is lost, even well-known companies can run into big legal and money problems.

Whether you’re involved or just watching, this is a good time to pause and think about how you choose your investments and who you trust.

Cases like this might feel uncertain, but they also give you a chance to learn and make better choices going forward. Take this time to tighten your process and protect your investments from risks you can avoid.

Also Read: Florida General Contractor License: Step-by-Step Guide for 2025